413 S Queen St, Martinsburg WV 25401

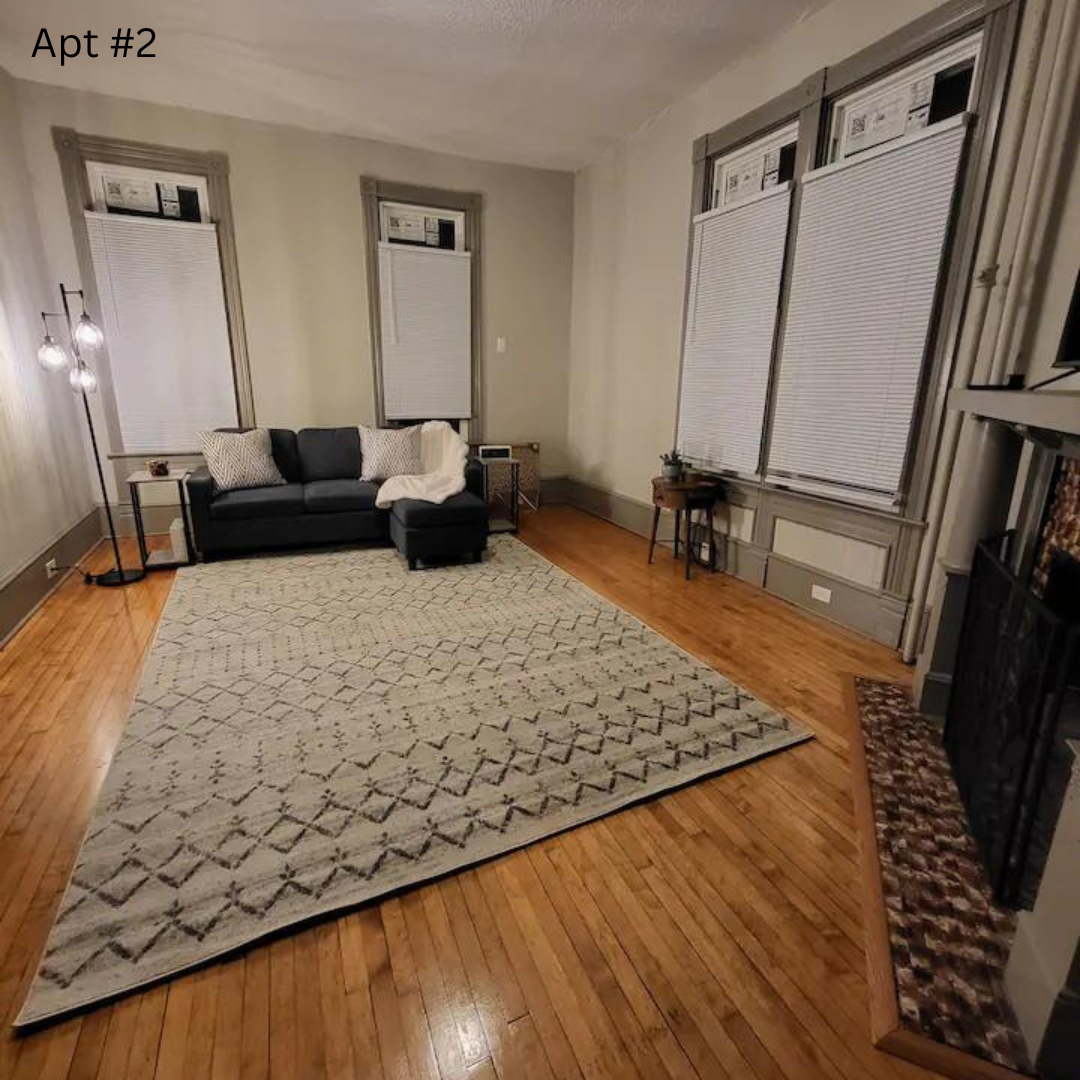

An amazing turn-key off-market opportunity awaits! To own a well-run commercial multifamily in a great location in Martinsburg. This property sits in an opportunity zone and has 8 individual (fully rented) rental units plus a large “carriage house” which contains 3 garage units that are fully rented. A private parking lot, a full basement, and a full attic allow ample extra space. Each apartment has been renovated and has updated kitchens, bathrooms, living rooms, and bedroom areas. The main secured entrance faces Queen St and sits beside the historic McFarland House.

This building features many updates!

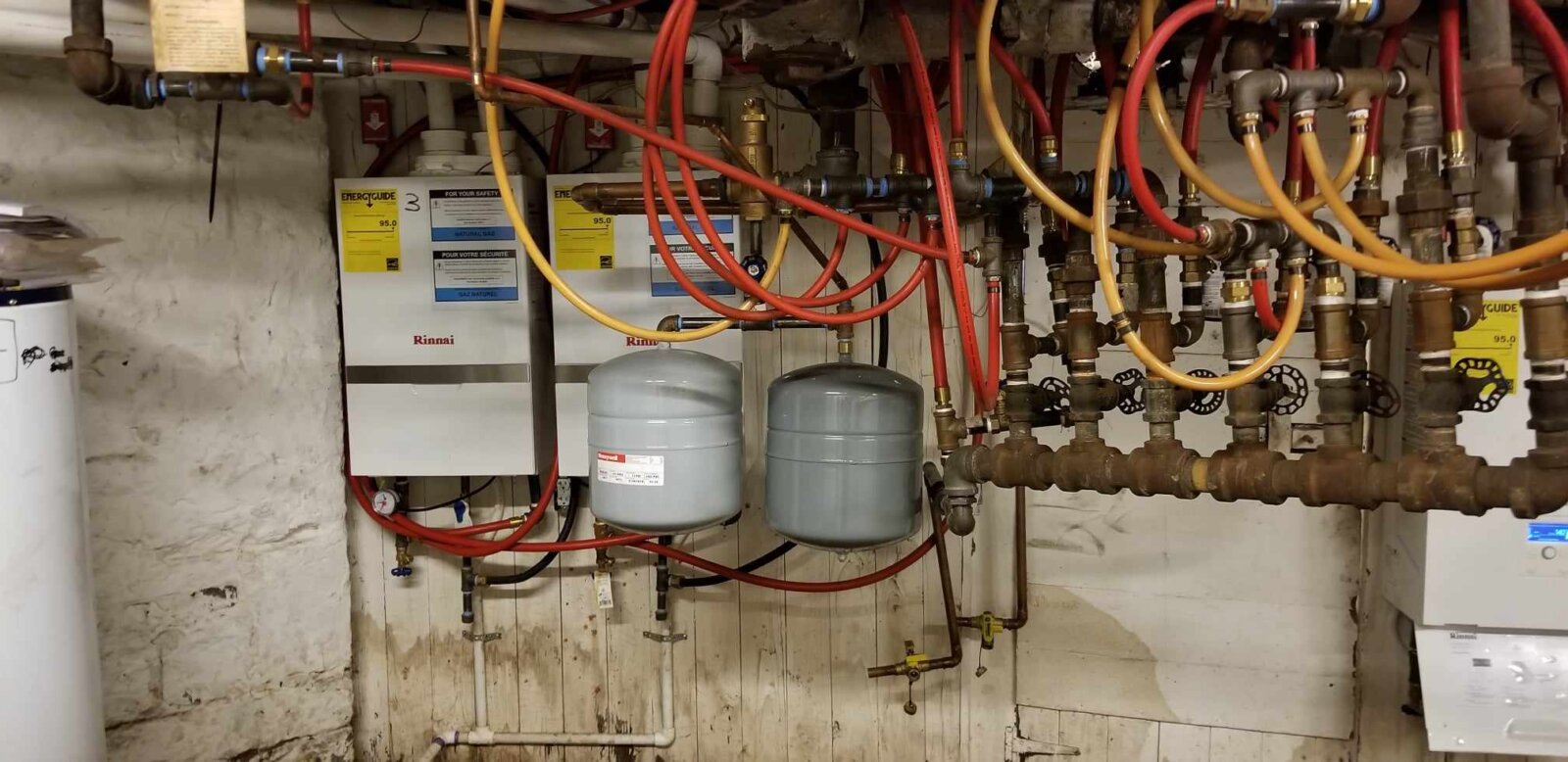

- All new individual gas boilers with individual gas meters

- Separate Electrical panel boxes for each unit

- All new vinyl windows

- Updated interior units: includes new flooring, paint, kitchens & bathrooms

- Updated hot water heaters for several units

- Secured entry on the main level with tenant mailboxes

- Off-street parking and rear patio area

- New Rubber Roof on Rear of Building

- Exterior painting

- Professional Management

The property currently grosses $7,345 monthly or $63,163.84 annually. Offering a 2% buyer commission. One of the owners is the listing agent. All showing must be accompanied by a Proof of funds to purchase. All pics are recent.

Call Bill at 301-707-1678

Multi-family investments are a wonderful way to create an additional income stream. As with any investment, there are pros and cons you should be aware of. The more you know about what to watch out for, the better decision you will make when it comes to multi-family investing. Here are some of the long-standing pros of owning Multi-family investments in Martinsburg West Virginia.

Pros

Higher Income

When you purchase a larger building you will have more doors and that automatically comes with higher income that provides a greater economies of scale. With single-family investment, vacancy will cause a loss of all rents but with larger buildings vacancy will not be as much of a concern.

More Doors

When you purchase a single-family home and rent it, you have one check coming in each month. If you were to buy a smaller, duplex or apartment building for a slightly higher cost, you can almost ensure you will never have a 0% occupancy rate. You will always have some sort of income coming in while you work to fill all of the units.

More “doors” also mean more checks coming in each month. And who doesn’t want more checks?

Lower Costs

Typically your costs are lower when you have multiple “doors” or units. Making a major repair to a house with one tenant will have less value than the same repair on an apartment building. For example, fixing a roof can affect multiple tenants, whereas the same repair, at the same price, will only affect one single-family renter. When you have several single-family homes, you can be making major repairs all year long!

Commercial Financing

Commercial financing can be more flexible and fewer hoops to jump through. You can use several creative methods to help get the building closed. There are fewer regulations to deal with than residential so that offers greater latitude or financing options.

One Stop Shop

If you own one building, you can pick up rent checks and make repairs all in one spot. If you are dealing with multiple single-family homes, you could end up driving all over town. Keeping a nice-sized investment property near your home can be a lower-maintenance way to make your multi-family investment.

MD WV Homebuyer is located in Martinsburg WV