Call Us! (301) 707-1678

Why Invest with Jump Capital ?

Many investors want passive income from an asset-backed investment without the hassle of managing real estate. Is that you too?

Here’s The Hidden Strategy (Once Accessible By Only The Elite Investors) To Earn Passive Monthly Income In A Safe, Income-Producing Investment

Real estate investing can be capital intensive and often requires additional funding after the acquisition is made but before a return on investment can be achieved.

For this reason, real estate investors rely on hard money loans to help them fund rehabs to bring their investment to a level that they can rent or sell.

This creates a win-win opportunity: Investors who need a short-term loan can borrow from a private real estate money lender to fund the rehab. If you are looking for a Hard Money Lender in Maryland, West Virginia, Virginia, or Pennsylvania we are here to help you get the funding you need. Jump over to the contact us page to schedule a strategy session call so we can discuss how we can work together to help grow your business with access to our capital.

7 Reasons Why Capital Investors Love Hard Money Loans For Real Estate

#1. Earn monthly income: borrowers make monthly

payments over the term of their loan until the entire loan is paid off. That means private real estate money lenders get regular passive cash-flowing payments each and every month.

#2. Enjoy passive returns: investing in real estate can be time intensive and effort-intensive. But providing a hard money loan to investors is a powerful way to participate in the real estate space without the hassles and headaches of managing real estate.

#3. Careful underwriting: borrowers must pass the underwriting criteria in order to qualify for a loan. Therefore, lenders can lend with confidence that borrowers have been carefully screened. (View our lending criteria here)

#4. Targeted borrowers: at Jump Capital, we don’t lend to just anyone. Our carefully selected target market includes experienced real estate investors with an existing portfolio of assets with equity who are financially comfortable already from existing businesses and real estate and are looking to play a bigger game and scale up. Our services are NOT for everybody and we’re pretty up-front about that, which means borrowers tend to self-qualify and lenders get the cream of the crop.

#5. Risk protection and limited downside: while no investment or loan is ever 100% guaranteed (and you should run from anyone who makes that claim), these loans are secure because they are backed by a real estate asset. On the rare occasion that the loan is not paid back, lenders are protected because of the value of the asset or protected with additional collateral.

#6. Accessible and liquid: with borrowing terms of 6-12 months, lenders enjoy the returns of an investment and the accessibility and liquidity of the shorter term. Your money is available to spend or re invest after the loan term is complete.

#7. Help others: providing hard money loans is a way to help real estate investors who want to complete their deals and rent or sell their property. Your loan keeps the deal – and the investor – moving forward. It also makes a positive impact on the economy by revitalizing the community!

Here’s How Our Loan Process Works…

...and How You Can Benefit As A Lender.

We’ve built a simple but effective system to help borrowers and lenders.

1. Real estate investors who need to borrow money will contact us for help.

2. We qualify the investors to make sure that they meet our underwriting guidelines.

3. If they do, we alert our list of private lenders (like you) to provide a loan.

4. When you see a loan you’d like to invest in, you let us know or we match you up based on past conversations.

5. We’ll take care of all the paperwork and money transfers (you don’t have to view the property or even meet the buyer).

6. Most important: as the borrower pays back their loan, we’ll deposit funds in your bank account each and every month until the loan is paid off!

Yes! I want to earn passive monthly income on an asset-backed loan to a qualified borrower.

Basic Investor Form

Fill out this short form for information on investment options we have available.

This is not a solicitation or offer of securities. Investment in Jump Capital is offered only to qualified investors through a written Investment Agreement or Private Placement Memorandum.

Investors Interested In Learning More? Submit Your Info Below.

EXPLORE FUNDING TODAY

Jump Capital - Hard Money Lending

If you are interested in obtaining a hard money loan, please complete the NO COST, NO OBLIGATION application below. You should fully complete all the sections of this form. After you complete this form, a representative will call you at the number you provide to us. All loans are “NO DOC” or “LIMITED DOC”. Information provided is strictly confidential. We do NOT sell or distribute your information.

We can be reached at (301) 707-1678

I agree to receive sms, email, and or phone communication.

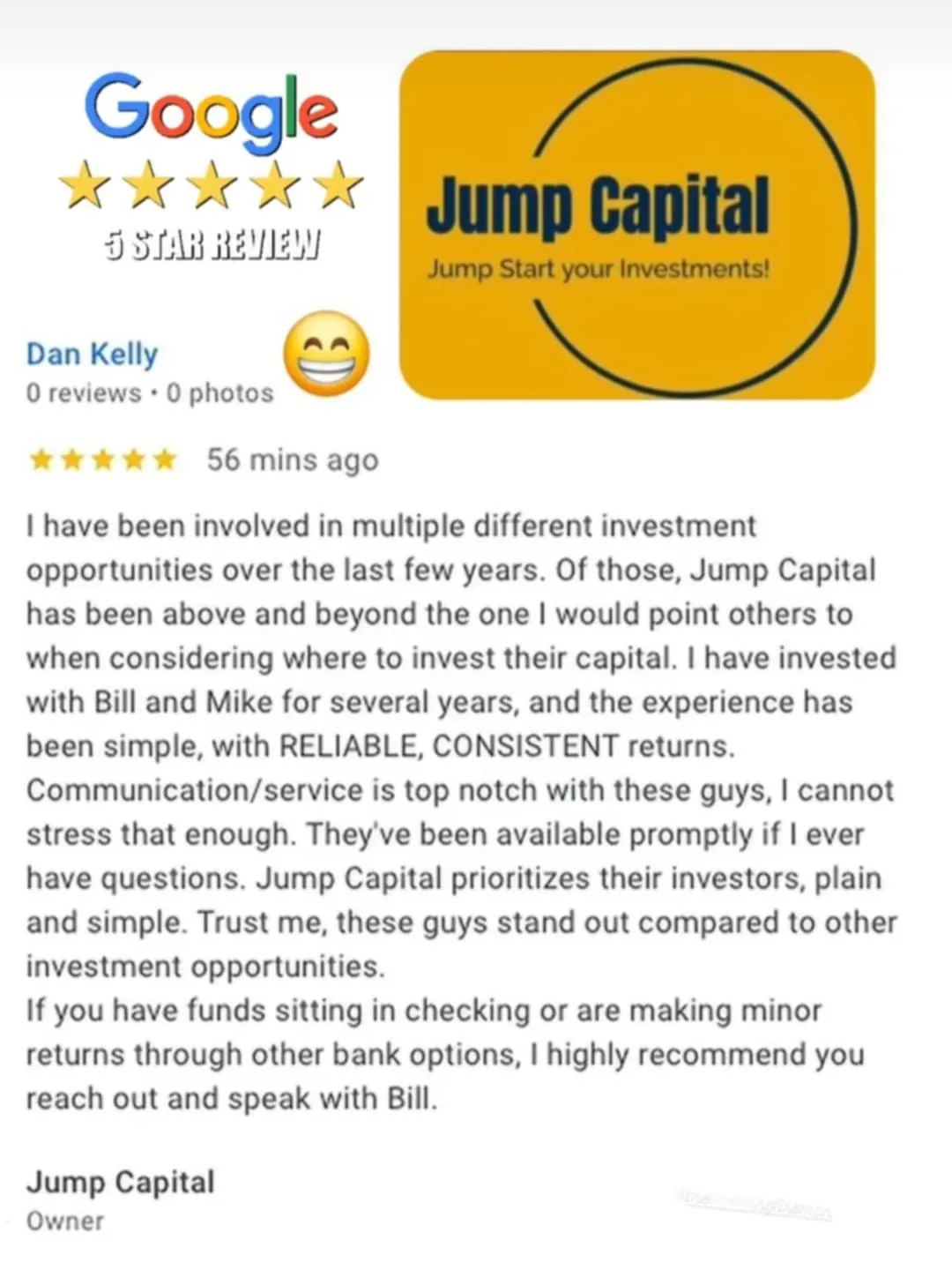

TESTIMONIALS

Accredited Investor Application Form

We present accredited investors with an opportunity to review quality deal flow that matches their criteria. Access to our opportunities is free for your use, however, you must be a direct, accredited or sophisticated investor. This section is not open to broker dealers/finders/middle-men. All applications are reviewed by hand. If you are interested in investment opportunities with us, please complete and submit the registration form below.

Accredited Investor Application

I agree to receive sms, email, and or phone communication.